Constitutional Revisions in Togo: Implications and Forecast

April 19, 2024

Senegal: Challenges Ahead for President Diomaye Faye

May 2, 2024NIGERIA: COUNTRY RISK OUTLOOK FOR BUSINESSES IN 2024 Q2-Q4

Analysts: Khadijah Mustapha, Cleopatra O.

What You Should Know

-

Security Risk: Nigeria faces security challenges from violent actors like Islamist extremists, bandits, secessionist movements, militants, cult groups and ethnic/communal militias. Renewed clashes between Boko Haram and ISWAP in the northeast and intensified banditry in central Nigeria highlights the severity and persistence of these threats. These security actors will likely restrict economic activities in northern and central Nigeria, likely affecting mainly key sectors like transportation, agriculture and oil production.

-

Political Risk: Pervasive corruption remains a major political risk for legitimate investments in Nigeria. Widespread corruption, coupled with lack of transparency and accountability in government, will likely continue to affect Nigeria’s market attractiveness.

-

Environmental Risk: Extreme weather events will likely worsen in 2024, likely threatening supply chains and increasing demand for imports. Food insecurity will likely worsen, with a projected 2% increase in the food insecure population.

-

Economic Risk: Nigeria’s economic outlook for Q2 to Q4 in 2024 will likely be underscored by a rapidly evolving policy landscape and resulting macroeconomic challenges. The economy will likely remain vulnerable to internal and external macroeconomic, security, and geopolitical factors.

Introduction

Nigeria, as Africa’s largest market with over 220 million people, presents vast demand and competitive opportunities despite bureaucratic and structural entry barriers. Its resource-rich environment, including being the ninth largest global oil exporter and holding 206 trillion cubic feet of gas reserves, offers significant business prospects. Nigeria’s robust non-oil sectors, such as services, further underscore its economic potential.

Risk Levels

Security Risk Analysis

Overview of Security Risk in Nigeria

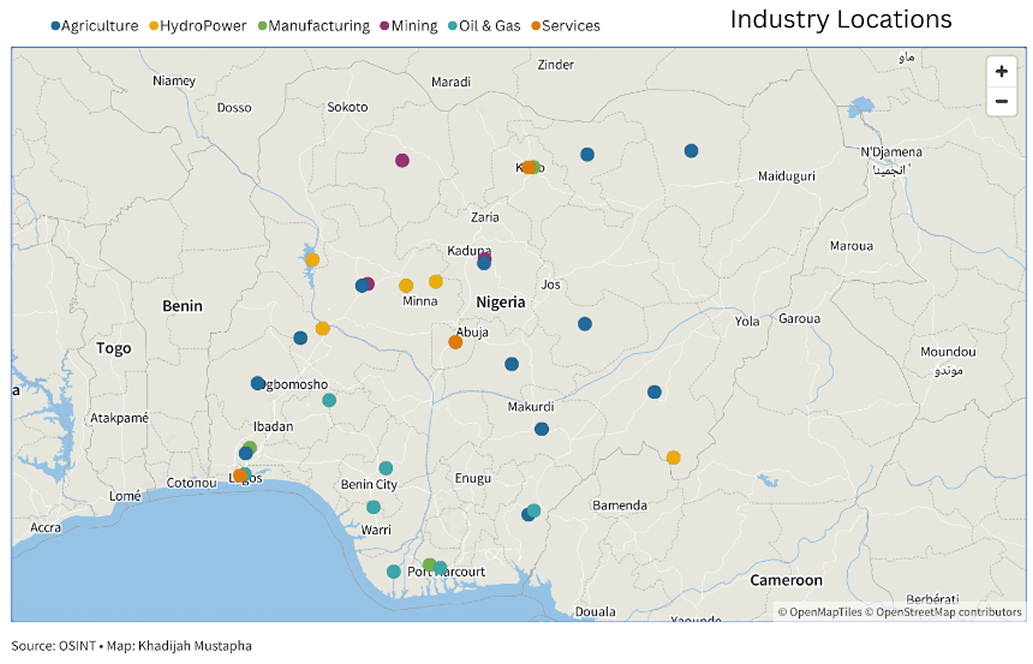

Nigeria’s security landscape is characterised by: Islamic extremists primarily located in the North, bandits operating in the Northwest and Middle Belt along with other criminal gangs across the country, secessionist movements in the Southeast and Southwest, militants and cult groups predominantly in the South South, Southwest and the Southeast, and communal and ethnic militia spread across various regions.

The main security risks include terrorism, armed clashes, attacks on civilians, abductions for ransom, vandalism and forms of sexual violence, often targeting citizens, foreigners, business employees, communities, and critical infrastructure.

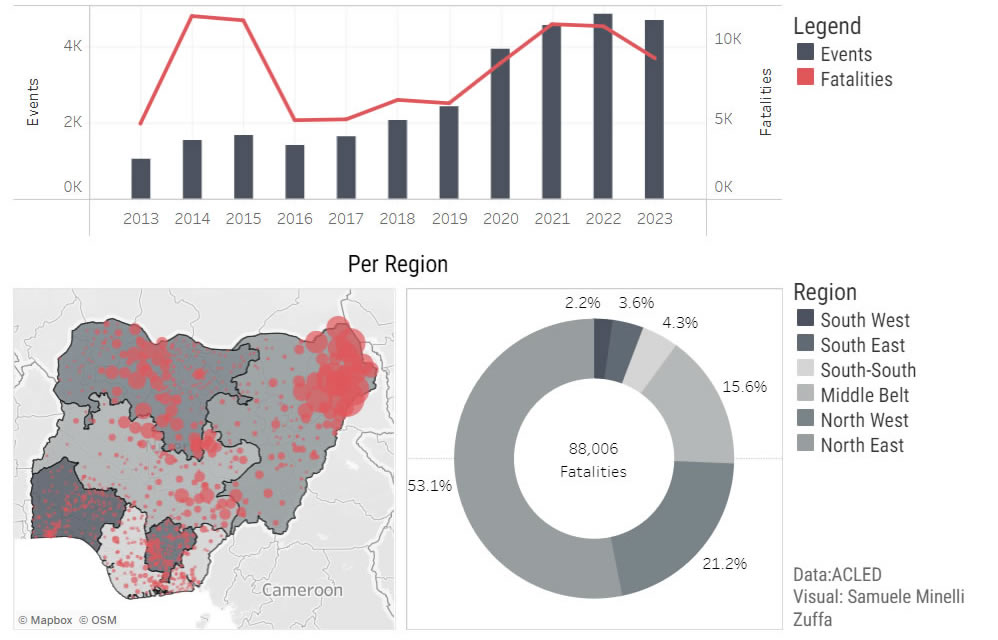

Violence in Nigeria (2013 - 2023)

These security actors overlap throughout the country, making the security risk widespread and unpredictable. Recent statistics indicate a 27.99% increase in security incidents and 19% increase in fatalities between October 2023 and March 2024 compared to the previous period.

Renewed clashes between Boko Haram and ISWAP in the northeastern part of the country have exposed millions of people to violence, restricting economic activities and rendering thousands homeless. Banditry has intensified around Plateau, Taraba, Kaduna, Benue and Enugu, while simultaneously maintaining some strongholds in the northwest. Protests against hardship and insecurity have increased, underlining the growing frustrations among Nigerians. Crude oil production has encountered significant losses due to oil theft and vandalism by militant groups and other crime gangs in the Niger Delta region.

Security Forecast for 2024 Q2-Q4

Clashes between jihadist groups will likely increase in north-eastern Nigeria, likely reducing economic activities in the region. Attacks and abductions will likely increase, likely targeting schools, farms, road networks, and local communities. Central Nigeria will likely become a hotspot for these attacks, very likely to be perpetuated by bandits, terrorist organisations, and other criminal gangs. These attacks will likely disrupt key sectors like agriculture, trade, and transport. Protests will possibly intensify if the current economic and security situation persists. The Niger Delta region will likely experience sustained declines in crude oil production due to ongoing incidents of oil theft and vandalism carried out by militant groups and criminal gangs. These activities will likely disrupt both production and transportation operations for oil and gas businesses between Q2-Q4.

Economic Risk Analysis

| IMF Economic Data on Nigeria | |||

| Metric | 2022 | 2023 | 2024 Forecast |

| Real GDP (Billion, USD) | 477.38 | 374.95 | 252.74 |

| GDP Per Capita (USD) | 2,200 | 1,690 | 1,110 |

| Growth Rate (%) | 3.3 | 2.9 | 3.3 |

| Inflation Rate (%) | 18.8 | 24.7 | 26.3 |

| Monetary Policy Rate (%) | 14 | 18.75 | 22.75 |

Key Economic Indicators - 2023

The Nigerian economy’s growth was slow at 2.9% in 2023, likely caused by 24.7% inflation, low revenue generation, currency volatility, 17.4% year-on-year depletion of foreign reserves, infrastructure deficiencies, and 37.5% multidimensional poverty. The multi-window foreign exchange (FX) market was volatile and had limited foreign currency supply following the proposed naira (NGN) redesign policy, amid a fixed FX regime that was 66% higher than the parallel rate.

| Nigeria National Bureau of Statistics Data. | |||

| Sector | Contribution to 2023 GDP (%) | ||

| Agriculture | 23.86 | ||

| Trade | 15.50 | ||

| Telecoms & Information Services | 14.00 | ||

| Real Estate | 6.06 | ||

| Oil & Gas | 4.70 | ||

| Financial Institutions | 4.66 | ||

| Manufacturing (Food, Beverage & Tobacco) | 4.12 | ||

| Construction | 3.47 | ||

| Services | 3.28 | ||

| Other | 15.69 | ||

Accounting for 89.23% of exports and contributing 4.7% to overall Gross Domestic Product (GDP), lower oil supply in 2023 impacted profits despite higher oil prices, affecting revenue although oil production increased by 8.13% in Q3. Non-oil sectors made up of services (56.55% of GDP), agriculture (26.11% of GDP) and industries (17.34% of GDP) also experienced contracted growth of 3.04% compared to 4.84% in 2022.

Government Policies and Impacts

President Bola Tinubu's government implemented two key fiscal policies in 2023, aimed at addressing revenue and inflationary factors contributing to slow economic growth. The removal of the fuel subsidy aimed to create fiscal space, expecting N3.9 trillion in fiscal savings (1.6% of GDP) likely to cover subsidy payment arrears and infrastructure improvements. The Central Bank of Nigeria (CBN) abolished FX market segmentation to eliminate rent-seeking and currency scarcity, promoting a market-responsive FX.

The reforms led to NGN depreciation, increased costs of import (52.6% of trade), and overall cost of living reaching 26.3% inflation in Q1 2024. High costs of input led to the contracted growth in many sectors, especially agriculture. The resulting macroeconomic crisis posed significant economic risks to oil and gas, manufacturing, and services sectors, already suffering from a $19 billion decrease in foreign direct investment (FDI) over the past decade. Despite initial challenges, the NGN showed temporary recovery in Q1 with a 6.89% appreciation against the dollar following CBN interest rate adjustments. While capital market reforms have led to marginally improved investor confidence, and will likely address FX volatility, concerns remain about the impact of higher interest rates on investment and economic growth. Government crackdown on crypto services also likely raises concerns about the future policy environment in the financial services sector.

Economic Forecast Forecast for Q2-Q4

The macroeconomic crisis will likely persist although the World Bank forecasts 3.3% economic growth. Despite trade barriers, Nigeria's business environment will likely become less risky with a more predictable FX market attracting foreign investment, especially in manufacturing, with $30 billion already committed for the next five years. Continued demand for foreign currency will likely sustain currency devaluation. The depreciation of the NGN and high fuel costs are likely contributors to the estimated 26.3% inflation, likely causing the projected 67% decline in real GDP.

Fiscal savings will possibly develop critical infrastructure, likely reducing business costs and easing inflationary pressures. Persistent inflation will likely increase poverty among low-income consumers, while effective budgeting and policy execution will possibly improve the purchasing power of middle and upper-income consumers. The Nigerian economy will likely remain sensitive to internal insecurity and external geopolitical factors, including oil pricing amid the Russia-Ukraine conflict, regional tensions involving China, and US election outcomes, impacting global markets, capital flows, and inflation.

Political Risk Analysis

Corruption extends into key state institutions, impeding business operations and challenging business integrity. Current corruption inquiries have been criticised as biased and inconsistent. The lack of accountability and transparency in governance adds complexity to the economic and regulatory landscape in the country, eroding public trust and creating loopholes for individuals to exploit. Nigeria faces a considerable risk of state seizure or violent terrorism, highlighted by a Political Stability score of -1.8. State sponsored ethnic tensions and disinformation during the 2023 elections remain prevalent online, increasing the possibility of escalating into inter-ethnic violence offline, especially in regions that have large ethnically diverse populations.

Since the 2023 election, the current government has renewed emphasis on nationalistic values, evident in its currency policies and regulatory initiatives such as the EEL (Employment Expatriate Levy). These measures are designed to nurture Nigerian talent and safeguard local industries. Given the high unemployment rates and growing youth population, Nigeria's workforce remains underutilised and increasingly discontented.

2024 Q2-Q4 Political Risk Forecast

Corruption will unlikely decrease between Q2 and Q4, despite the government's efforts to curb it, likely continuing to impact the country’s market attractiveness. Systemic policies targeting corruption will likely take longer to implement because of friction amongst political affiliates and opposition. Corruption inquiries on the same trend will likely cause further division and stoke Inter-ethnic tensions online and possibly escalate into physical violence and rivalries. Nationalistic policies will likely encourage investment into training the underutilised Nigerian workforce, possibly creating a better pool of candidates for businesses to employ.

Environmental Risk Analysis

Overview of Environmental Risk in Nigeria

Developmental challenges, poverty, and insufficient infrastructure exacerbate the impacts of climate change in Nigeria, such as irregular rainfall and land degradation. These factors trigger worsening floods and erosion in the south, and drought and desertification in the north. Seasonal flooding varies by region from May to November, exacerbated by poor flood waterways and blocked natural flood plains. Heatwaves and unstable annual variance cause additional flooding in the north. Deforestation and loss of biodiversity result from human activity such as illegal felling, unplanned industrialisation, and wildlife trafficking, leading to soil erosion, air pollution, and loss of 80% of Nigeria’s forests.

Implications for Key Industries

Environmental risks contribute to economic risks as they damage vital infrastructure primarily affecting the food and energy sectors, leading to food and energy insecurity, inflation and reliance on imports. 5% of the population faced food insecurity in 2023, partly due to extreme weather events that threatened food production. As of Q1 2024, the Famine Early Warning Systems Network (FEWS Net) estimates that most Nigerian states, particularly in the northeast, are experiencing 'level two stressed' or worse food security outcomes, according to the Integrated Phase Classification scale.Shrinking lakes and rising sea levels further threaten the fishery sector, which contributes 4% of GDP.

2024 Q2-Q4 Environmental Risk Forecast

Extreme weather events will likely worsen in 2024, likely threatening food and energy supplies and causing ripple effects throughout the economy, including an increased import demand. Record-high heat waves, floods, and droughts are likely in Q2 and Q3, likely straining national supply chains, causing loss of revenue, and increased inflation. The food insecure population will possibly increase to 7% in alignment with FEWS Net’s estimation of ‘level two stressed’ and ‘level three crisis’ food security outcomes, although Nigeria is unlikely to reach ‘level five famine.’